D&B Rating enables quick assessment of a company's financial strength and creditworthiness. The

Rating is comprised of and presented in two components:

-

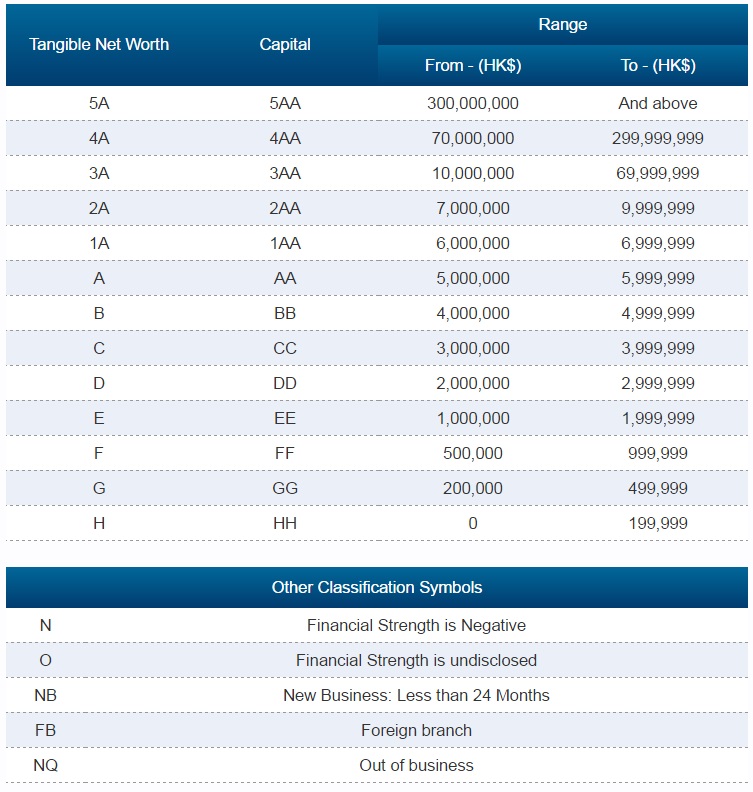

Financial Strength reflects a company's tangible net worth from the most recent audited financial

statements or capital

-

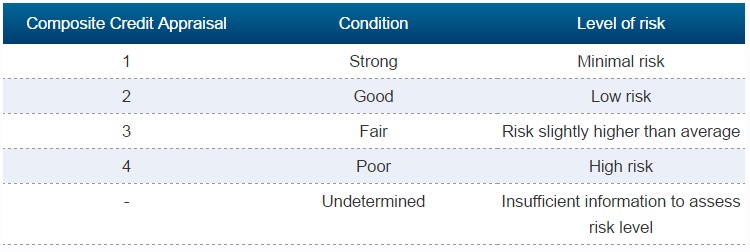

Composite Credit Appraisal reflects a company's health, stability and overall condition, and is

derived from the D&B Failure Score

Financial Strength

The following table shows the relationship between the Financial Strength indicator and an organization's tangible net

worth or capital:

Composite Credit Appraisal

The D&B Failure Score is taken into account as a major component when assigning a Composite Credit Appraisal. The

following table shows the relationship between Composite Credit Appraisal and level of risk:

Learn more about D&B Risk Management Solutions >